Tata NEU | Tata Pay

Led design of Tata Pay enabling to strengthen Tata Neu's position in the digital payments industry by adding its own UPI service across web, mobile and native platforms, including planning, testing and execution. Guiding team members on topics such as accessibility, implementation of design tokens etc.

The Goal

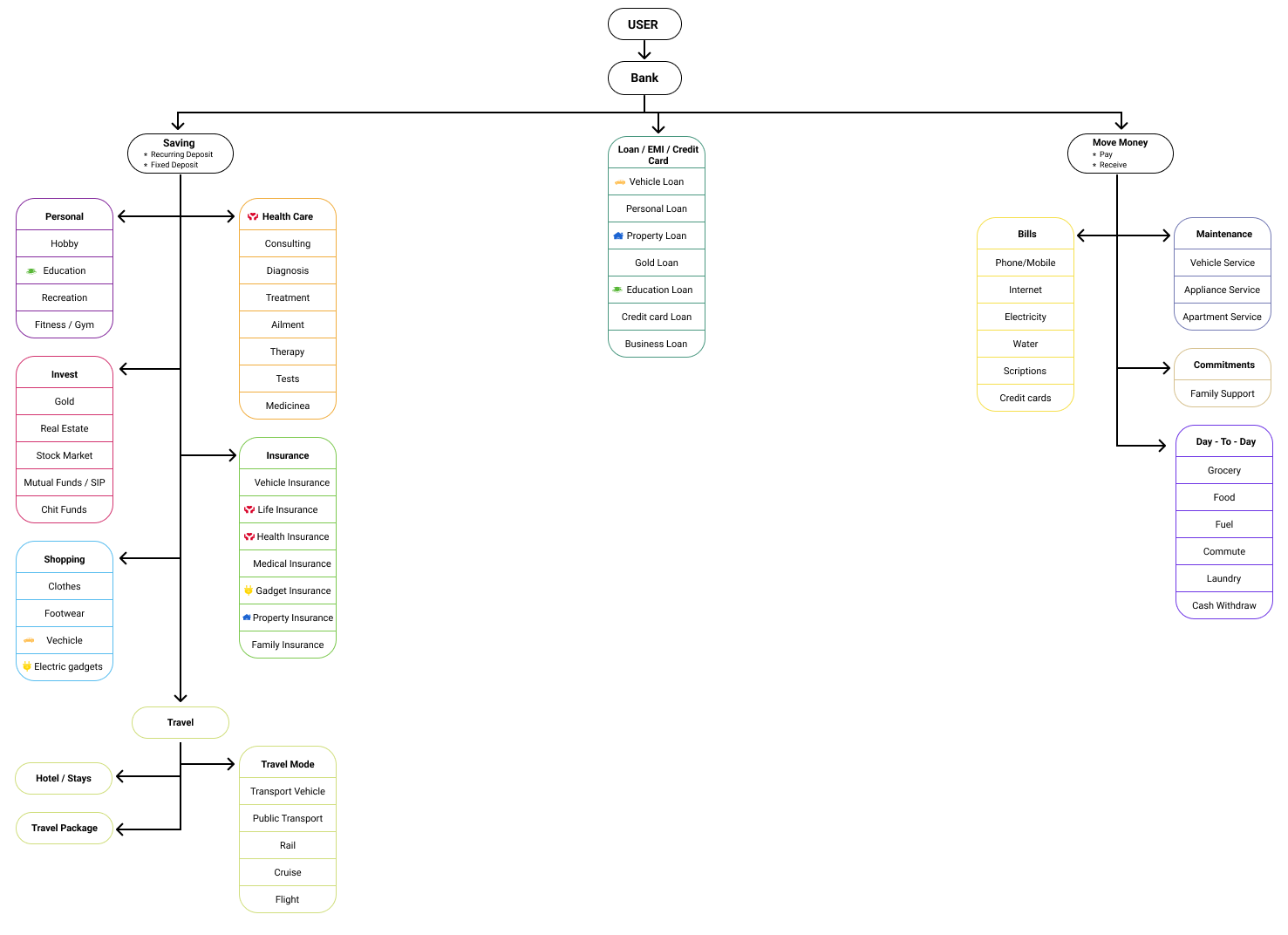

To design a NeoBanking app for India that provides end-to-end banking and financial service to customers with multiple bank accounts, simplifying banking and is a single destination for all banking operations and more.High-level Objectives

- To create a type of direct bank that is 100% digital and reaches users on mobile apps.

- To digitally reinvent the practices and processes associated with traditional banking.

- To create a userfriendly banking user interface to improve the experience of both parties.

- To host a safe financial environment.

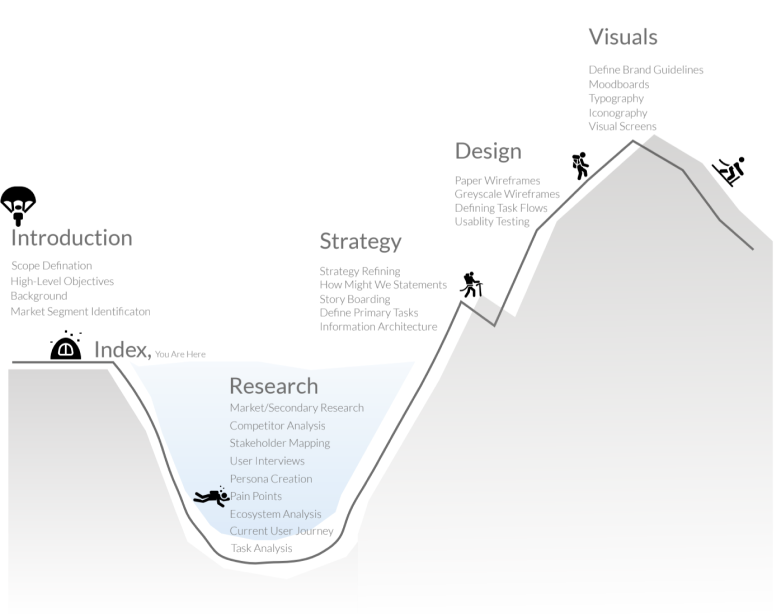

Design Process

Overwiew of the design approach followed. The process was not fixed & varied based on products service or system lifecycle & requirements which included lending, cards, insurance, digital gold, reward based points, UPI and UPI mandates (B2B, B2C, P2P) .

Tools used

- Figma

- Miro

- Optimal sort

- Adobe creative suite

- Google survey

- Tata analytics

- Power point

- Qualitrics

Dependencies

- Availability of market & research data

- Timelines of associated products

- Existing Tata product resources at disposal

- Organizational maturity

- Stage of current product development

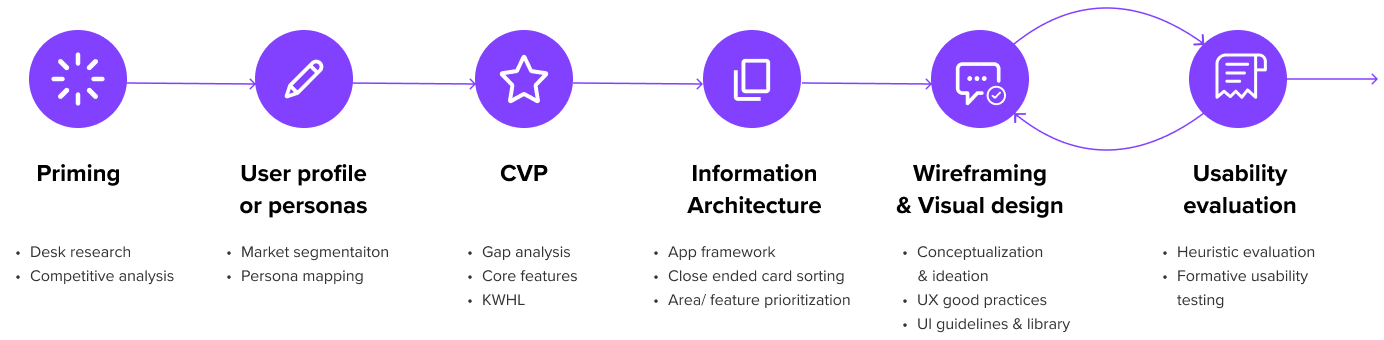

Methodology vs Technique

Agile Development or User-Centered Design methodology was. adopted which assisted in outlining the principles, processes, and practices that the design team followed to achieve the project goals effectively.To address particular aspects of design, the design team employed specific techniques within a methodology such as wireframing, user research, or payment security design ,

While methodologies provided a structured framework for development, techniques offered actionable steps for executing design tasks and solving specific problems encountered during the design process

Initial Research

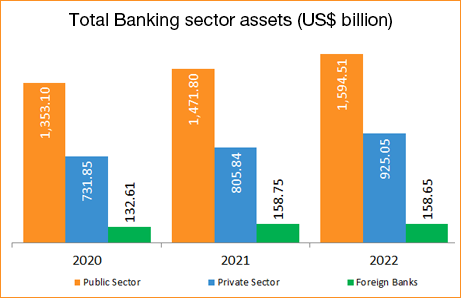

Market Research

As per the Reserve Bank of India (RBI), India‘s banking sector is sufficiently capitalised and well-regulated. The financial and economic conditions in the country are far superior to any other country in the world. Credit, market and liquidity risk studies suggest that Indian banks are generally resilient and have withstood the global downturn well.

Literature review

In their study, Devi, Sebastina, and Kanchana (2011) explored customer perceptions of mobile banking. While providing this service, they recommend that clients be informed of all the benefits and drawbacks of mobile banking. Further simplification of the usage is needed, and as clients are concerned about security while using technology in banking, service providers must offer sufficient security services

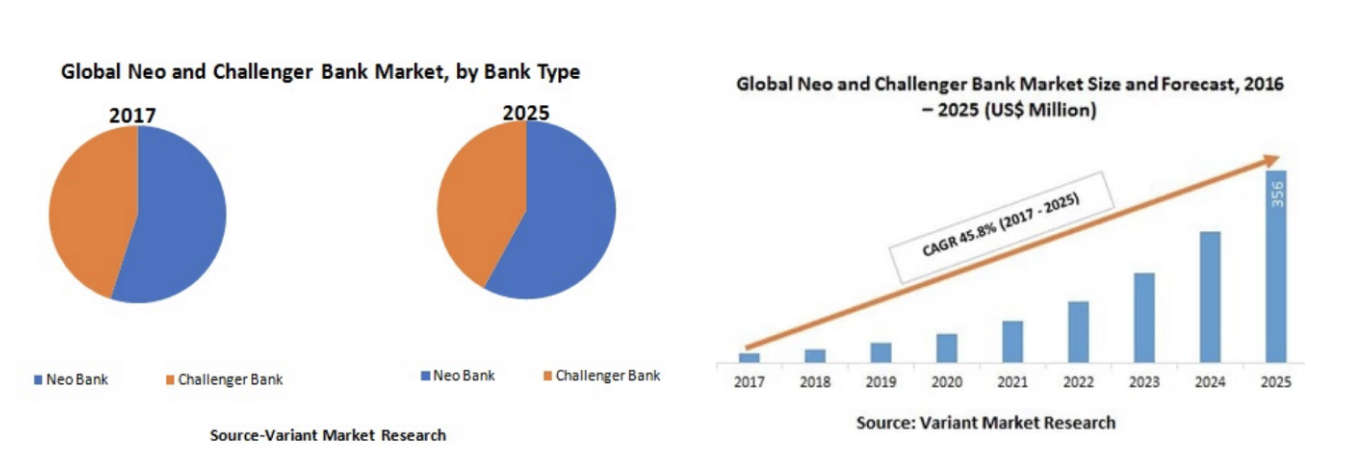

What about Challenger Banks then? A modern form of banks to challenge NeoBanks, but owned by traditional banks.

(Challenger banks are similar to NeoBanks. They are a modernized form of a traditional bank, which functions without physical offices or branches. Have their own bank license, hence, have the right to offer banking service.)

Example: Kotak 811, YONO SBI...

Statistics for Neobanks and Challenger banks

The research study by HTF Marketing Report provides forecasts for Neo and Challenger Bank investments till 2022..The rate of return expected for money invested on NeoBanks is to grow more than 12 times from its beginning balance to its ending balance.

Stakeholder Analysis

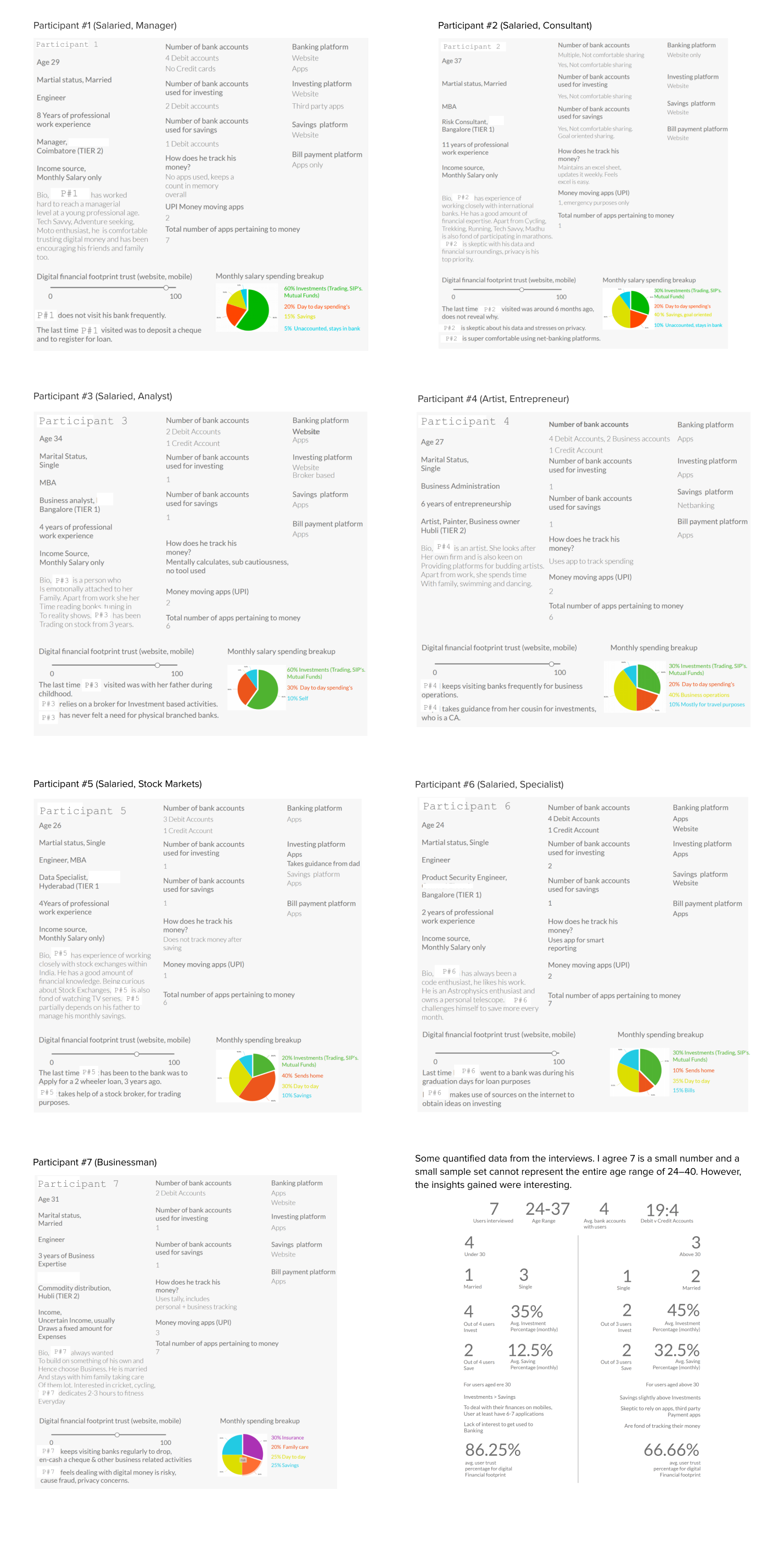

User Interviews

The target audience for my research were mainly people between ages of 24–40 with jobs, businesses, and even entrepreneurs. All these users had a different financial pattern and also this age range dominated the digital financial footprint.

During my research, I managed to interview 7 individuals from different backgrounds and from different tier of cities as well. Apart from the 7 individuals, I managed to speak to a few more on their financial handlings but off-record, however, this exercise added useful insights while creating personas.

User Persona Exploration

Along with these interviews, I had conversations with a few people I meet every day. Asking them about their experiences with banks, applications, investment, and money tracking. This helped dilute the inclination of the 7 users whom I interviewed.

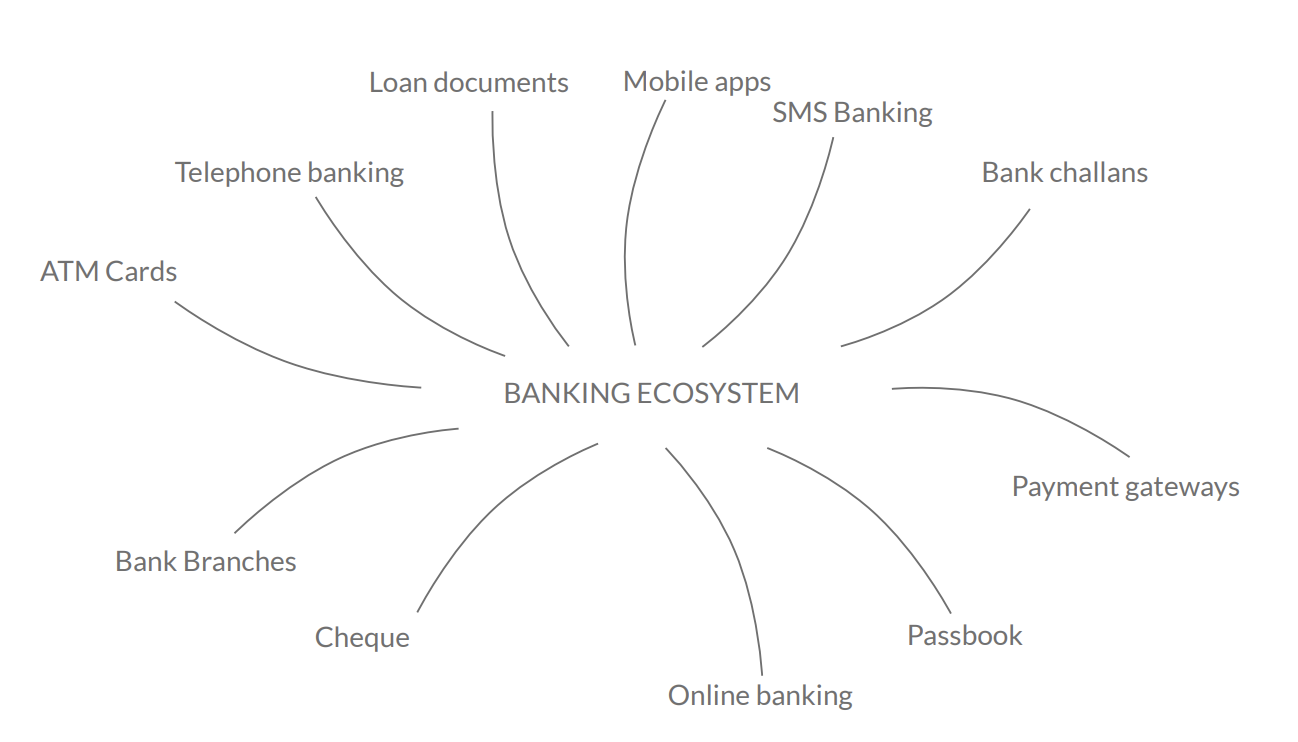

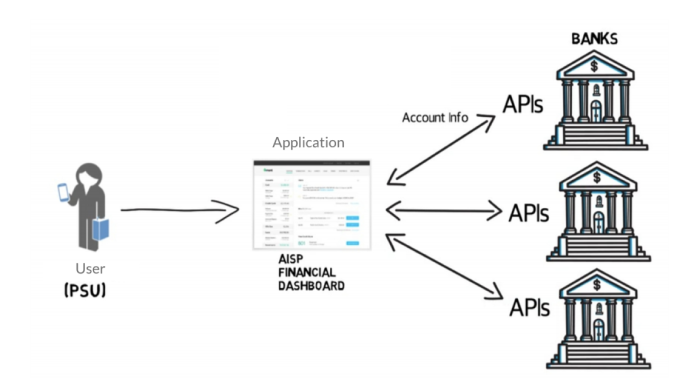

The Banking Ecosystem, from the eyes of the user

Attracting both Businesses and Personal banking, the banking ecosystem today is not only bound to websites, apps on laptops or mobiles but still exist in the physical form being the branch office itself. Adding to that, checkbooks, passbooks, challans, acknowledgments, ATM receipts, certain onboarding procedures, and more still exist on a paper form. An active user, who uses bank accounts frequently with time only develops more such data in physical or digital forms. Hence, leaving the banking ecosystem with loose ends.

The challenge with Tata Pay as a Neo bank was to understand the processes involved in the physical ecosystem and to create seamless experiences between the digital and physical world and between different softwares.

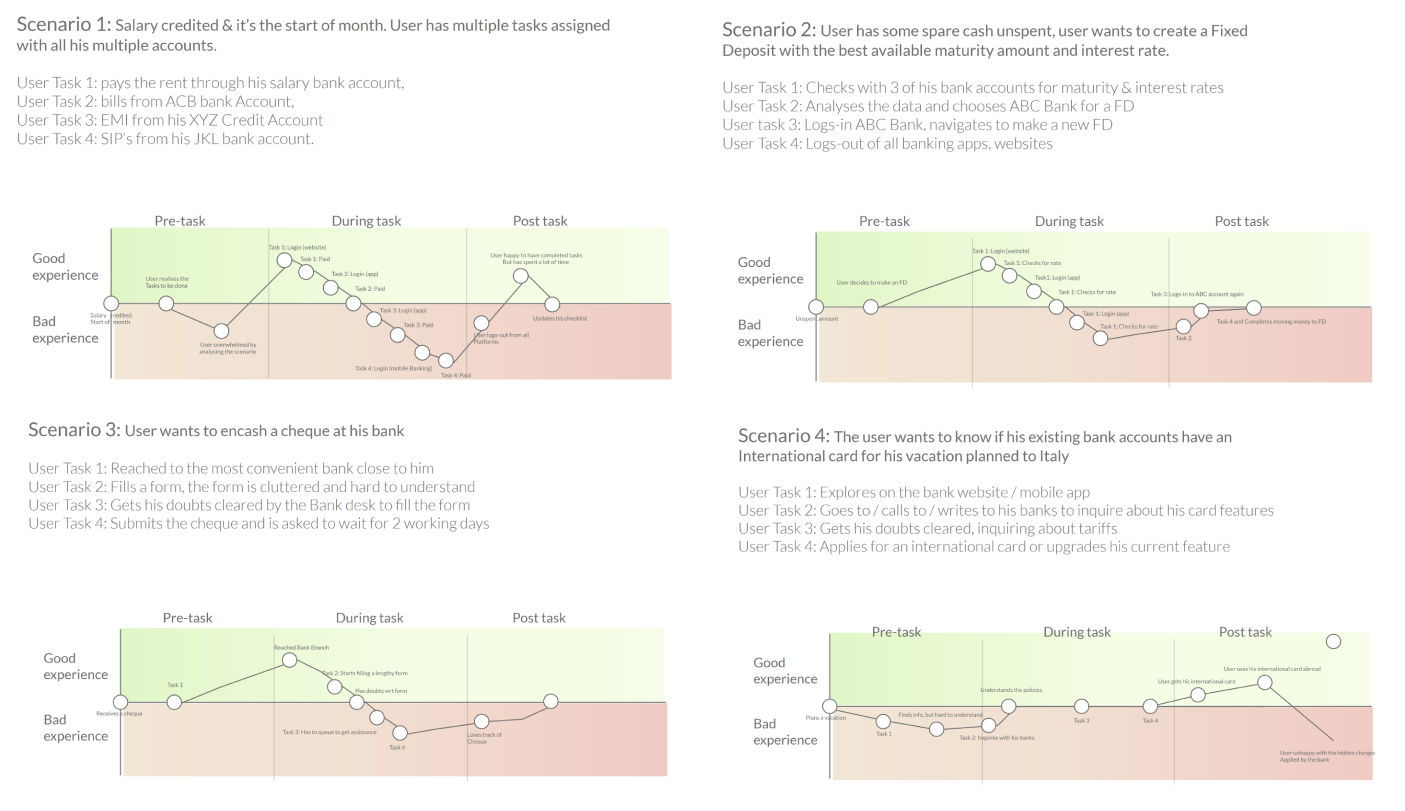

Current User Journeys, based on the interviews

Some common pain-points

- Lack of transparency between banking Policies and norms, awareness of bank account features. Vocabulary used is not simple.

- Lack of user interest and time to learn or get used to banking on applications or visiting physical banks. Banking pictures a complex image for most users.

- Multiple bank account creates multiple Banking credentials, thus, is challenging to the user memory. Users go to multiple destinations For various financial operations be it a bank, branch, app or website.

- It takes 7 steps on a website and 8 minutes on average to block bank offer calls which bug the user several times a day.

Strategy

After the research, it was time I revisited my objectives with this study. This was for me, a very exciting phase of this study as I got a chance to reflect on my research findings. The perspective gained, things changed, objectives were reinforced — for good!

- Help user take a pulse of his/her existing loans, assets, investments, liabilities. Provide insights so the user gets more confident and makes a proper judgment.

- Track the user’s everyday expenses, including the smallest of all the expenses. Categorize them into groups and give a visual representation of the same.

- Users having 1 or more bank accounts should be able to access, transfer, receive, encash a cheque, track status, know more about their accounts and offers — all under one application. This looks overwhelming, but the sign-up process must be seamless and easy.

- Users must be able to create their goals and saving to achieve the goals should be encouraged by the application. The user will be able to give access to his created goals to whomsoever he wishes to, be it a friend, parents, children, wife, sibling, mentor. The goals will have a social touch, wherein the looped people will be able to react, comment, and advise on goals.

- Payments. Paying bills. Splitting bills.

- Learning must be promoted. Socialize goals.

"Keep banking simple, vocabulary simpler, accessibility simplest! "

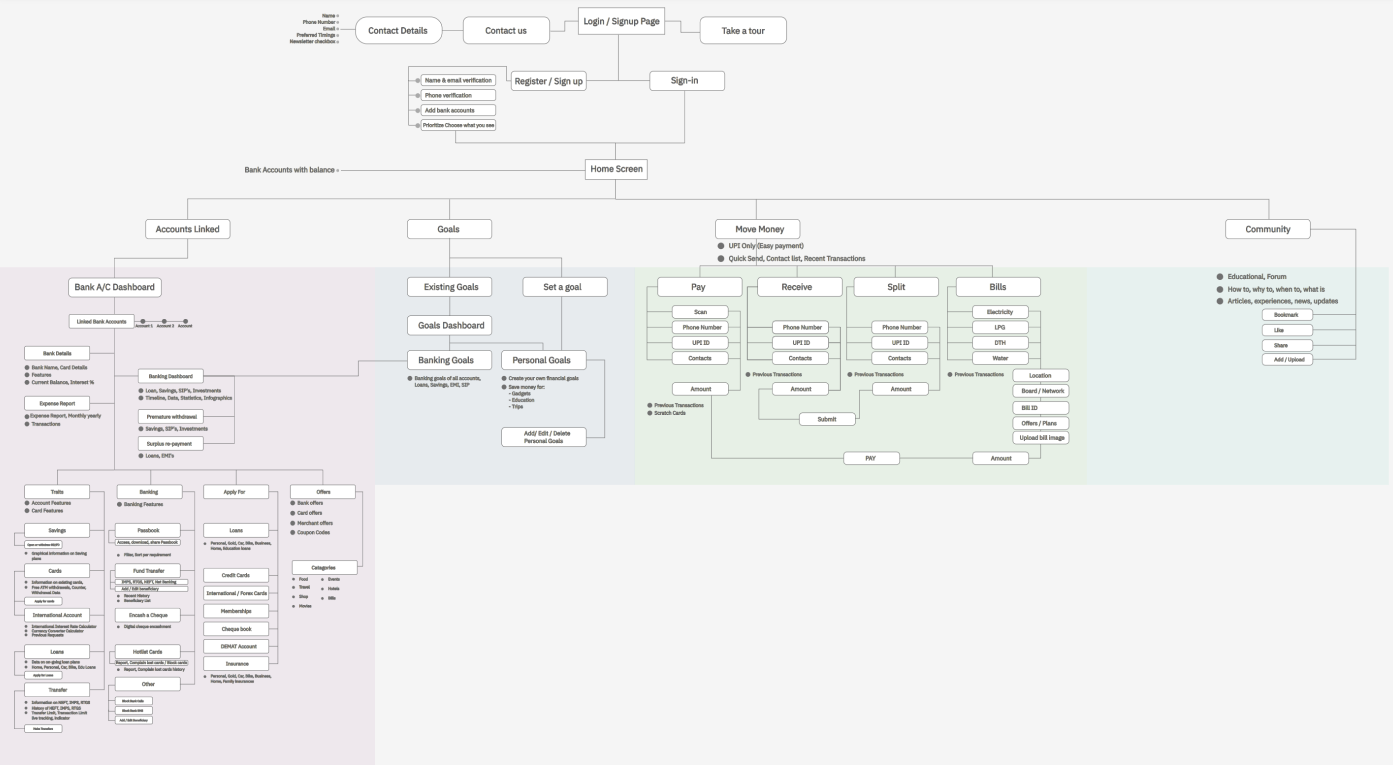

Information Architecture

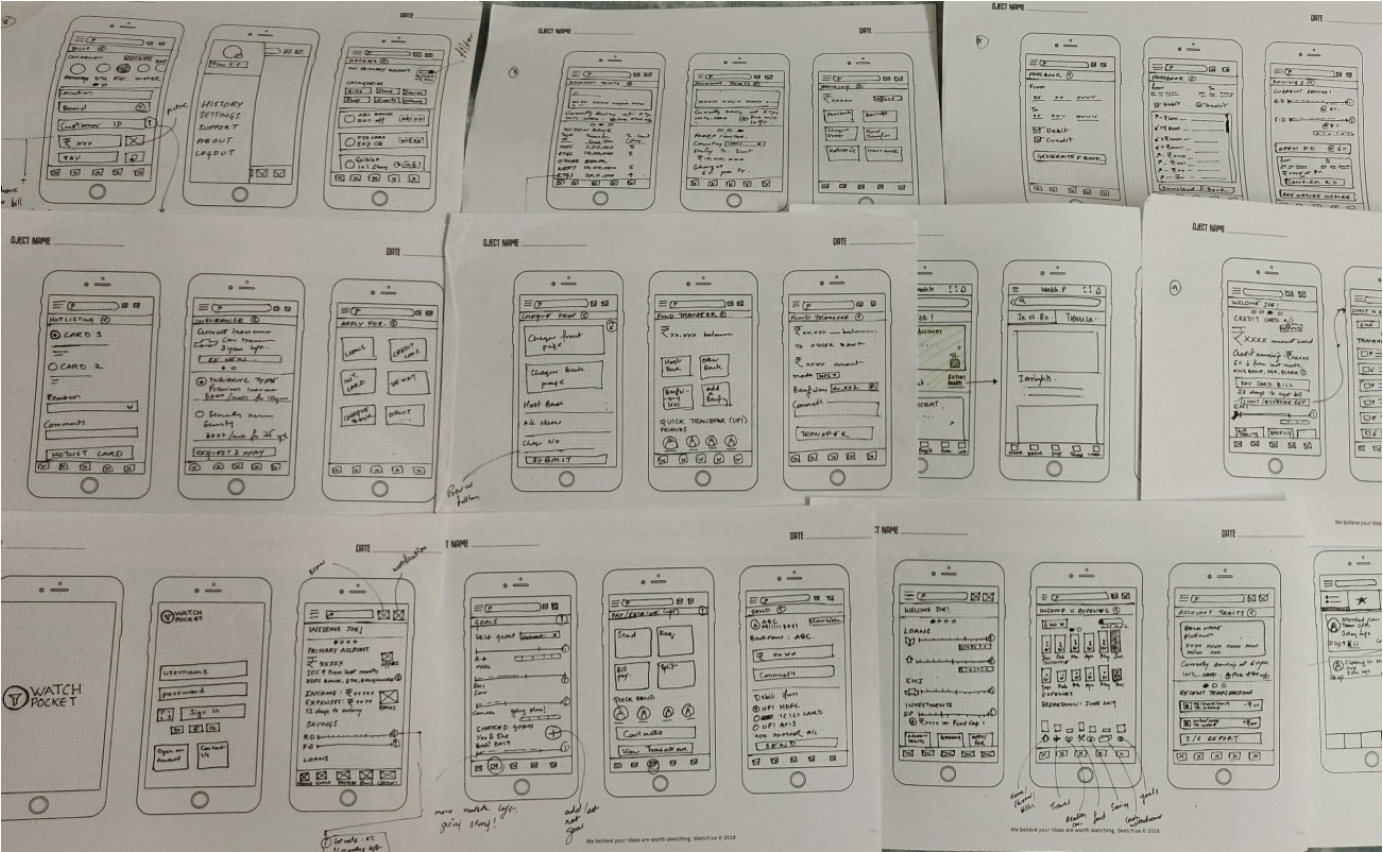

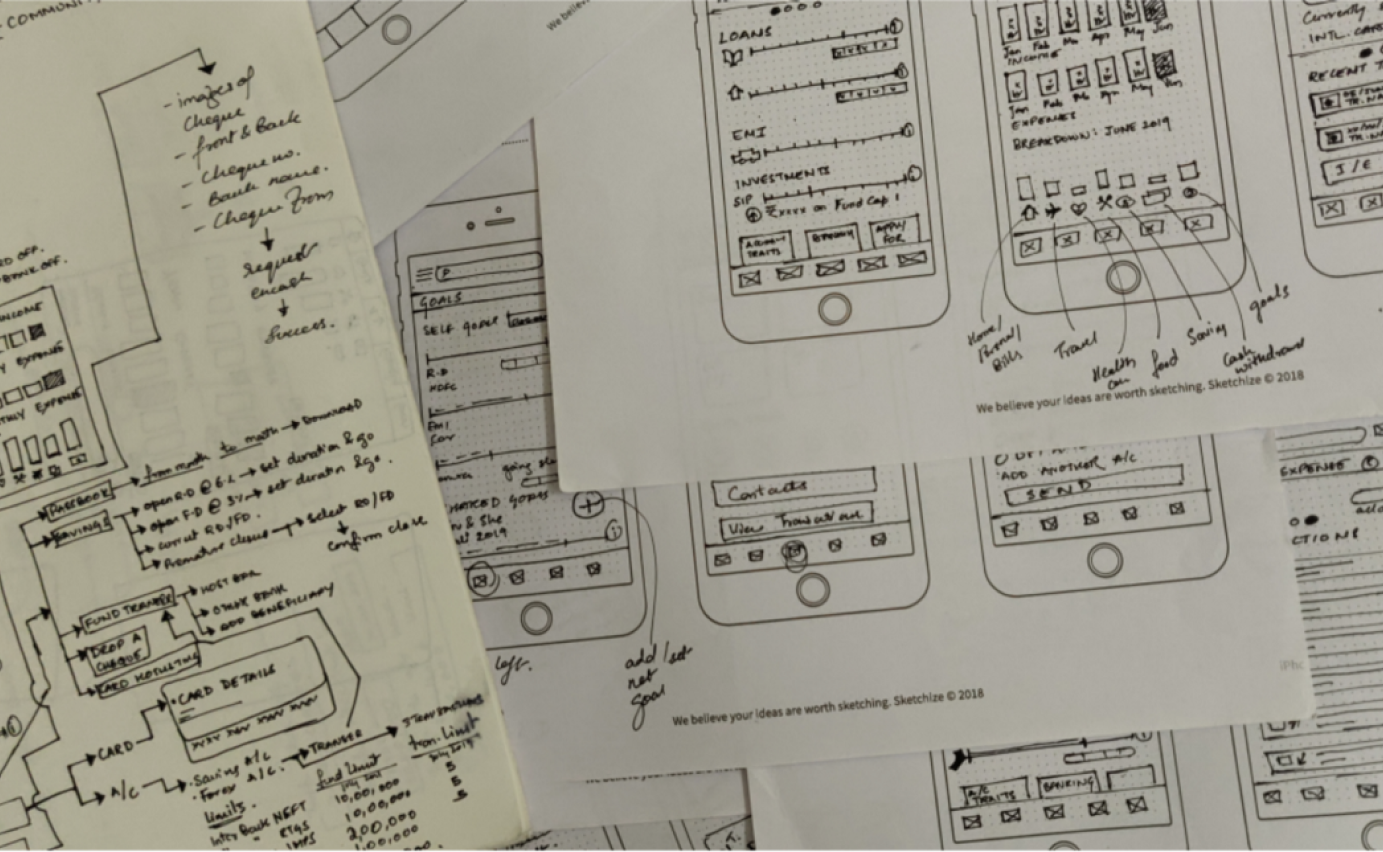

Design

After all the juggle and struggle I was relieved to reach the Design stage of this product. 😁

- I named my product before I dived into the design. Why TATAPay? Cause there are two ways you can look at this, and both of them convinced me.

- First step toward banking under TATA Brand.

- Referring to Nike’s famous advert lines ‘Just Do It’.

As a practice, I started off with creating paper wireframes.

Copyright ©. All Rights Reserved. — Designed with love by Rbiswas